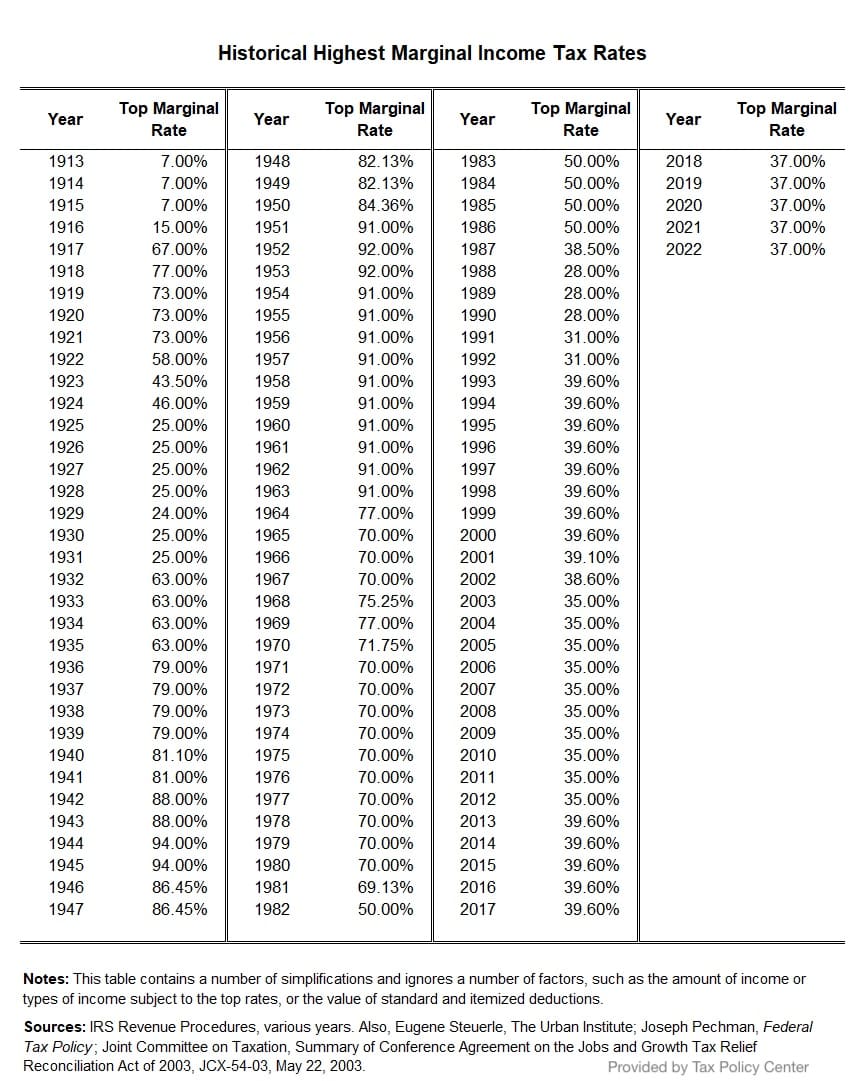

Tax Foundation on Twitter: "MYTH: US income taxes on the rich were much higher in the 1950s. While marginal income tax rates are down from 91/92%, changes in the tax base—how much/what

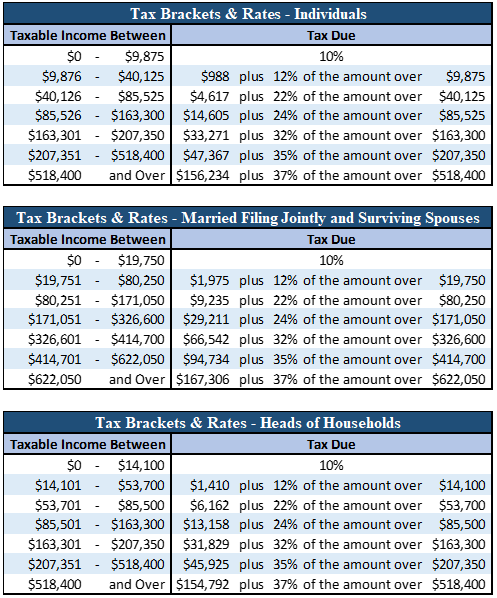

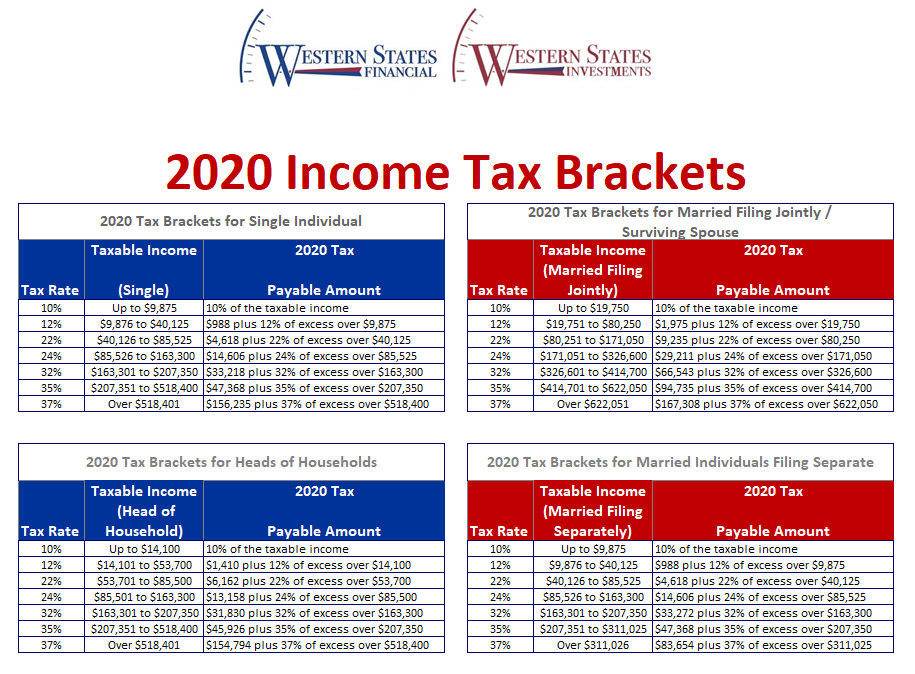

2020 Federal Tax Brackets, Tax Rates & Retirement Plans - Western States Financial & Western States Investments - Corona , CA John Weyhgandt, Financial Coach & Advisor

![Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic] Taxing The Rich: The Evolution Of America's Marginal Income Tax Rate [Infographic]](https://specials-images.forbesimg.com/imageserve/60868250060f8ad8dd0c97eb/960x0.jpg?fit=scale)